If you have been reading my articles on the Brixton property market recently, you will see that in the three years since the referendum of the ‘B’ word (that word is banned in our household), we have proved beyond doubt that it (whose name shall remain nameless) has had no effect on the Brixton property market (or the UK as a whole).

So one might ask, what does affect the property market locally? Well many things on the demand side include wages, job security, interest rates, availability of mortgages, confidence in the economy, inflation, speculative demand … the list goes on. Yet as my blog readers will note, I like to delve deeper into the numbers and I have found an interesting correlation between unemployment and the number of properties sold (i.e. transactions).

Why transaction levels and not house prices? Well just looking at Brixton house prices as a bellwether has flaws. Many property market commentators and economists believe transaction numbers (the number of properties sold) give a more accurate and candid indicator of the health of the property market than just house values alone. The reason is twofold. First most people when they sell also buy, so if property values have dropped by 10% or risen by 10% on the one you are selling, it would have done the same on the one you are buying – meaning to judge the health of a property market is very one dimensional. Secondly, the act of moving is very much a human thing. Property habitually conveys a robust emotional connection with homeowners – a connection that few would attribute to their other investments like their savings or stock market investments. Moving home could be described as a human enterprise, moving from one chapter of one’s life to another. When people move home, it shows they are moving forward in their lives and so this gives a great indicator of the health of the property market.

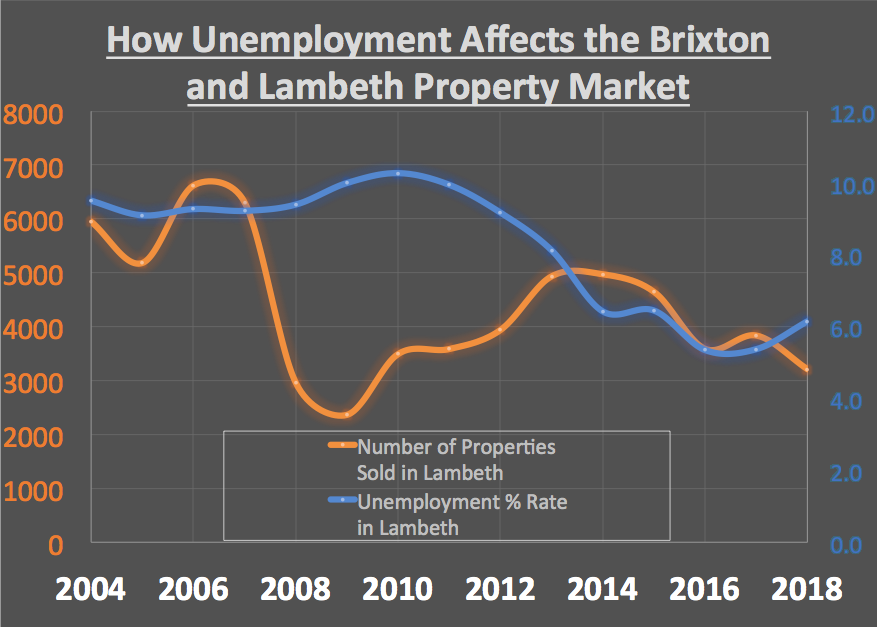

If we look at the national picture since 2004, there has been an inverse relationship between unemployment and housing transaction levels (i.e. as unemployment rose nationally in 2008/09 – housing transactions dropped – yet as the national economy started to improve in 2011, unemployment dropped and housing transactions increased) yet Lambeth has bucked that trend.

Property transactions in Brixton dropped by 62.52%, whilst unemployment in Brixton rose by 8.4% during the 2007 to 2009 Global Financial Crash

Matylda Nowak

Local Property Expert