Over the past five years, the thumbscrews on the buy to let market for British (and de facto) Brixton investors have slowly turned with new barriers and challenges for buy to let investors. With the change in taxation rules on mortgage relief starting to bite plus a swathe of over 320 pieces new rules and regulations for landlords, it cannot be denied some Brixton landlords are leaving the buy to let sector, whilst others are putting a pause on their portfolio expansion.

With the London centric newspapers talking about a massive reduction in house prices (mainly in Mayfair and Prime London – not little old Brixton) together with the red-tape that Westminster just keeps adding to the burden of landlords’ profit, it’s no wonder it appears to be dome and gloom for Brixton landlords … or is it?

One shouldn’t always believe what one reads in the newspaper. It’s true, investing in the Brixton buy to let property market has become a very different ballgame in the last five years thanks to all the changes and a few are panicking and selling up.

Brixton landlords can no longer presume to buy a property, sit on it and automatically make a profit..

You have to make sure that your property is of very good standard, make sure you are up to date with current regulations. Brixton landlords need to see their buy to let investments in these tremulous times in a different light. Before landlords kill their fatted calves (i.e. sell up) because values are, and pardon the metaphor, not growing beyond expectation (i.e. fattening up), let’s not forget that properties produce income in the form of rent and yield. The focus on Brixton buy to let property in these times should be on maximising your rents and not being preoccupied with just house price growth.

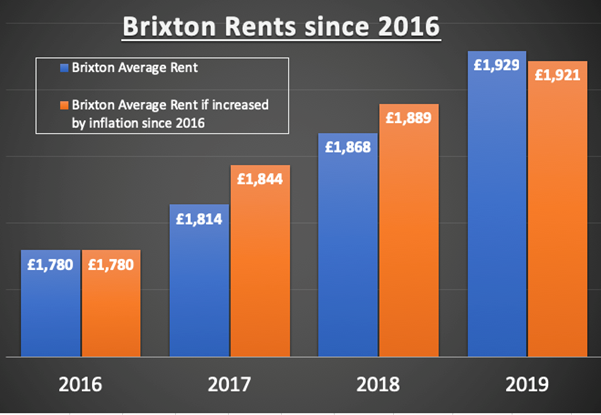

Rents in Brixton’s private rental sector increased by 3.29% in the past 12 months

Rents in Brixton since 2008 have not kept up with inflation, it is cheaper today in REAL TERMS than it was 11 years ago and some landlords are beginning to realise that fact with our help.

Looking at the last few years, it can be seen that there is still a modest margin to increase rents to maximise your investment (and it can be seen some Brixton landlords have already caught on), yet still protect your tenants by keeping the rents below those ‘real spending power terms’ of the 2008 levels.

Buy to let must be seen as a medium and long-term investment ….

Rents in Brixton are 8.38% higher than they were 3 years ago

…and for the long term, even with the barriers and challenges that the Government is putting in your way – the future couldn’t be brighter if you know what you are doing.

Investment is the key word here… In the old days, anything with a front door and roof made money – yet now it doesn’t. Tenants will pay top dollar for the right property but in the right condition. Do you know where the hot spots are in Brixton, whether demand is greater for 2 beds in Brixton or 3 beds?

Whether apartments offer better ROI than terraced houses? With all the regulations many Brixton landlords are employing us to guide them by not only managing their properties, taking on the worries of property maintenance, the care of property and their tenants’ behaviour but also advising them on the future of their portfolio.

We can give you specialist support (with ourselves or people we trust) on the future direction of the portfolio to meet your investment needs (by judging your circumstances and need between capital growth and yields), specialist finance and even put your property empire into a limited company.

If you are reading this and you know someone who is a Brixton buy to let landlord, do them a favour and share this article with them – it could save them a lot of worry, heartache, money and time.

Matylda Nowak

AUTHOR OF BRIXTON PROPERTY BLOG, CEO, Kings Accommodation